Live session date: 2025-07-12

Objectives

- Understand different user research methodologies

- Plan out how to conduct user research

- Perform effective user research to understand your user’s pain points and needs

Learner Journey

- Conduct preliminary research - if there is a problem in the society, we form an hypothesis, then we have a base or a goal to look forward to achieve our research objectives

- Formulating a hypothesis

- Establish your research objectives

- Choose the right research approaches

- Develop detailed

Key documents we create post research

- Personas: A fictional character that displays key characteristics that help us understand our user (key pain points, current bheaviours, lifestyle, demographics)

- Customer journey maps: A detailed explanation of a user journey to uncover how the journey looks like today, before we develop an improved customer journey.

The Big Picture

- Market Analysis - what does the market look like, the existing competitors. where are some areas that I can exploit as a business?

- Market Selection - Whom do I target? How do we position ourselves?

- Marketing Mix - What does the product look like? What is the price point and so on? What is the placement of the product?

- Acquire Customers - What is the marketing and sales funnel look like? How can we gain customers and retain them?

- Product Launch - Budget, timeline, milestones, metrics, etc.

We need to go through this whole process for a product.

A market is a group of buyers with common needs

Preliminary Research

Understand your company’s market analysis and strategy

Before starting the user research, understand where the company is going

Conduct prelim research to understand what information exists:

- Internally - who are our users today? What information do we have? What am I hired for? So am I starting fresh or am I going with what others have already worked on?

- Externally - Search for relevant articles, books, experts, case studies, interviews on the area that you want to focus on. Eg. sustainable transportation - find articles that others have already written. This just gives you an understanding of the landscape.

Take notes on the key themes and understand what the problem space and user space is looking like. Example, in the EV industry, the main challenge is to store the energy in a battery. So what are the possible solutions? How does this affect sustainability. Take notes on this, what does it look like on a macro level and micro level.

From this, you should get a feel for where the opportunities lie in the industry.

Example - The Economist

AJ was given a budget to develop a new product.

He was tasked with finding new audiences and revenue opportunities in Asia.

His first challenge was to find out who his readers are and who is customers are.

Attitudes: Globally curious people, appreciate different perspectives Habits: Voracious readers, like to have detailed reading times, most encountered Economist in the college Demographics: Affluent people, $220k per year, 80% male readers Market size: 1-2% of the total population Brand affiliation: Mercedes, Rolex, international property etc

Formulation of hypothesis

- China, Korea, Japan were the biggest opportunities

- Target audience: local execs that have studies overseas, work for global companies, just want a global perspective.

- Biggest challenge - censorship (China), and translation into local language on a timely basis

Ideally have multiple hypothesis and talk to industry experts and eliminate hypothesis if they don’t seem favourable or seem too far fetched.

Choosing the right research approach

- Created a research briefing - shared with research companies to see how they would approach the research and then to finally choose one to work with

- Target output - right persona, right target customer, and right competitor

- Winning staragey

- Run initial screener question to their panel of respondents to qualify them in or out of the research

- Do you reg read global news

- Are you interested in the issues and topics in facing humanity

- Qualified respondents were asked to join a 3 hour focus group for a fee

- Signed NDA - goal was to have 5-6 respondents as a part of each focus group

- Run initial screener question to their panel of respondents to qualify them in or out of the research

Conduct the research

- After the focus groups, we designed a survey questionnaire and ran the survey in each country. Target 400 completed surveys in each market

- After a few weeks we had a final report on each country, and a comparision of each market

- Outcome: China was identified as the most attractive market to focus on, and had 2 clearly defined personas to look at - the persona that aligned with them was uni students who wanted to improve the nuances of their English languages - very niche group and they looked to The Economist as a learning tool. This is a new customer segment that didn’t exist in the West.

Generate hypothesis

A testable statement that tries to explain relationships - once tested it can get rejected or approved

A good hypo should be clear, testable and based on prior knowledge

Prioritize hypotheses

- User criteria such as potential impact, feasibility, alignment with company strategy, and resource availability to prioritize your hypotheses.

- Creating a scoring system or matrix to objectively evaluate each hypo

Next ask the right questions - research objectives

- Why are we doing this?

- Who do we want to study?

- What do we want to study and why?

- Where do we want to do the research?

- How will we conduct our research?

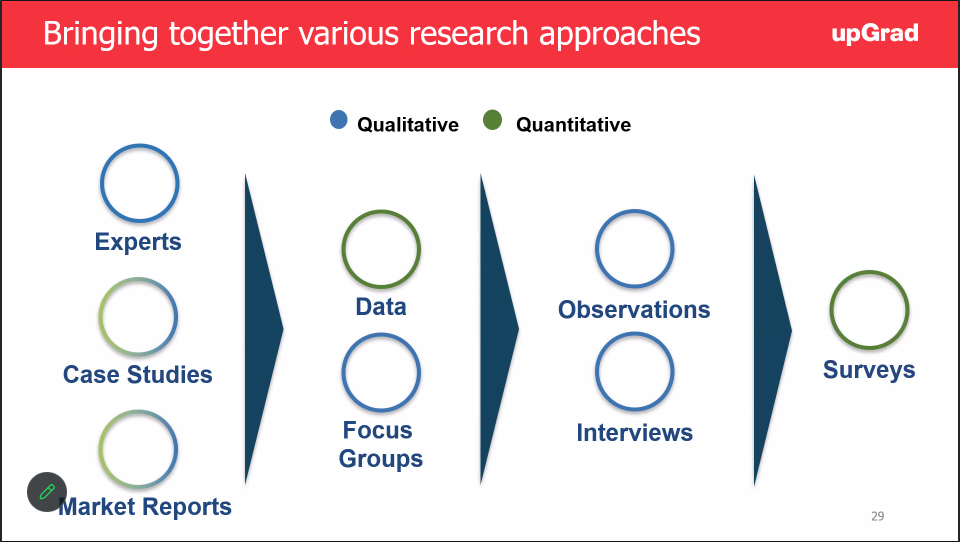

Choosing right research approach (types of research)

- Primary research

- This is one that you do yourself

- Secondary research

- Gathering info from research that someone else has already conducted

You want to get qualitative data - from focus groups, interviews You want quantitative data as well - from data sets, surveys, experiments and so on

Qualitative Research

- User interviews

- just one on one convos - experiecnes, opinions and so on

- It can be strcutured, or unstrcutred

- Field studies - takes place in user’s context

- Direct observation to understand better users and what they do

- Eg: listening to support calls, watching the people in an amusement parrk

- Contextual inquiry

- Diary studies - journal or something similar spread over a longer period of time

- Habitual usage data - times, primary tasks

- Change in attitude - brand perception, how loyal are they make their first purchase

- Focus groups - informal technique to help asses user needs

- Bring 6-9 users and lead users through a set of questions

Neilsen Norman group - YouTube channel

Triangulate

Focus Groups - prefer this - a great place to start to get a broad overview of the topic from different perspectives Interviews - go deeper to learn about individual prefs Surveys - after you have done qualtitive research, we know issues and now we would want to quantify how many

Good vs bad survey questions

- Don’t ask leading questions - Do you believe responsible parents would clean restaurants vs how important do you feel the cleanliness of a restaurant would be to parents?

- Avoid loaded questions - where do you buy luxury products - it assumes the user buys luxury products

- Avoid multiple questions in one questions - on 1 - 5 how happy are you with the salary and work benefits

B2B research

- We need to do primary research - ideally

Activity

PayTM would like an opportunity to get into small business loans.

- Establish TAM through market sizing

- What the size of the loan is

- What is the interest rate

Conducting user research

- Primary research first

- What are the current problems

- What kinds of loans they have available to them currently

- How many would want to have the risk of taking a loan

- How many can pay back

Surveys

- Do they require some one to guide them

- Average monthly revenue

- Segment of their business

- How frequently they are using PayTM

- What is the perference - online or offline method of payment